Counterparty Credit Risk Model Python

Here well show an example of code for cva calculation credit valuation adjustment using python and quantlib with simple monte carlo method with portfolio consisting just of a single interest rate swapits easy to generalize code to include more financial instruments supported by quantlib python swig interface. Comprehensive experience in market risk credit risk oprisk modelling model validation and fraud misconduct detection and data protection.

Counterparty Credit Risk And Cva Matlab Simulink

Counterparty Credit Risk And Cva Matlab Simulink

Counterparty risk is the likelihood or probability that one of those involved in a transaction might default on its contractual obligation.

Counterparty credit risk model python. We will do this by conceptualizing a new credit score predictive model in order to predict loan grades. We might speak of credit risk when you enter a trade for which you are seeking compensation primarily for the risk that your counterparty might not pay you back. Cva calculation with quantlib and python.

Iv scorecard woe credit risk updated oct 16 2019. We specifically focus our attention on credit risk and identifying the key drivers behind the default of a loan. A netting agreement will reduce your exposure and therefore the counterparty credit risk.

A python package for credit risk card. Counterparty risk can exist in credit investment and. A predictive model that uses several machine learning algorithms to predict the eligibility of loan applicants based on several factors.

Counterparty credit exposure calculation 22 main challenges. Soon this guy will take your job and generate your credit score. Finally counterparty default probabilities are typically derived from credit default swap cds market quotes and the cva for the counterparty can be computed according to the above formula.

In this post we will use data science and exploratory data analysis to delve deeper into some of the borrower variables such as annual income and employment status and see how they affect other variables. Main source for model risks o simplest model but complicated enough to capture main properties of the underlying risk factors o calibration of model parameters. Canabarro and duffie 2003 provide an.

1 simulate yield curve at future dates. The uncertainty of exposure and bilateral nature of credit risk. Selection of risk factor models and calibration of model parameters.

Explore and run machine learning code with kaggle notebooks using data from multiple data sources. This is the case of a corporate bond for example in which case you are first and foremost taking a view on the credit quality of the issuer. There are however two features that set coun terparty risk apart from more traditional forms of cred it risk.

Assume that a counterparty default is independent of its exposure no wrong way risk. Counterparty risk is similar to other forms of credit risk in that the cause of economic loss is obligors default.

Cva Calculation With Quantlib And Python Jupyter Notebooks A

Cva Calculation With Quantlib And Python Jupyter Notebooks A

Did Anyone Tried To Build A Credit Scoring Model In Rapidminer

Did Anyone Tried To Build A Credit Scoring Model In Rapidminer

Frontiers An Artificial Intelligence Approach To Regulating

Frontiers An Artificial Intelligence Approach To Regulating

Fincad Client Case Studies Overcoming Challenges With Xva S

Fincad Client Case Studies Overcoming Challenges With Xva S

Foundations Of Credit Risk Modelling Archives Finance Train

Foundations Of Credit Risk Modelling Archives Finance Train

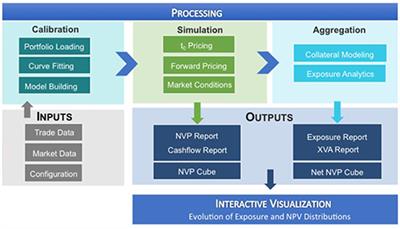

Calameo Compatibl Risk Platform

Calameo Compatibl Risk Platform

Creditr R Package To Enhance Credit Risk Scoring And Validation

Creditr R Package To Enhance Credit Risk Scoring And Validation

Credit Risk Analyst Resume Samples Qwikresume

Credit Risk Analyst Resume Samples Qwikresume

Pricing Crypto Exchange Credit Risk By

Pricing Crypto Exchange Credit Risk By

Fed May Delay Counterparty Limits For Foreign Banks Risk Net

Financial Risk Analyst Efinancialcareers

Financial Risk Analyst Efinancialcareers