Counterparty Credit Risk Metrics

Over the counter otc derivatives are subject to counterparty credit risk. It also explains how credit risk can be measured reduced and mitigated.

Counterparty Risk Some Way To Go For Derivatives

Counterparty Risk Some Way To Go For Derivatives

Counterparty credit risk is the risk that the counterparty to a trade or trades could default before the final settlement of the transactions cashflows 1 bilateral credit risk of transactions with uncertain exposures that can vary over time with the movement of underlying market factors 2 exposure is the.

Counterparty credit risk metrics. Only contracts that are privately negotiated between counterparties ie. Lets contrast counterparty risk to loan default risk. This article serves as an overview of counterparty credit risk and outlines terminology used in credit risk management.

It captures changes in counterparty credit spreads and other market risk factors. Counterparty credit exposure is a measure of the amount that would be lost in the event that a counterparty to a financial contract defaults. The most commonly used metric to capture counterparty exposures is the current exposure at a given point in time.

Cva risk was a major source of unexpected losses for banks during the great financial crisis. Counterparty risk is the likelihood or probability that one of those involved in a transaction might default on its contractual obligation. Material to the calculation of capital charges for default risk and cva risk is the measurement of the exposure.

Counterparty risk can exist in credit investment and. Traditionally the management of credit risk at energy and commodity trading firms has largely been a passive exercise in which a credit limit is assigned to each trading counterparty based primarily on its internal rating score. Counterparty risk is a type or sub class of credit risk and is the risk of default by the counterparty in many forms of derivative contracts.

This potential mark to market loss is known as cva risk.

Counterparty Risk Benefit Assessor Intedelta

Counterparty Risk Benefit Assessor Intedelta

Counterparty Risk Icon

Pdf A Gentle Introduction To Default Risk And Counterparty Credit

Pdf A Gentle Introduction To Default Risk And Counterparty Credit

Https Www Kbc Com Content Dam Kbccom Doc Investor Relations Results Jvs 2018 Risk Report 2018 Pdf

![]() Credittracker Pioneersolutionsglobal Next Generation C Etrm

Credittracker Pioneersolutionsglobal Next Generation C Etrm

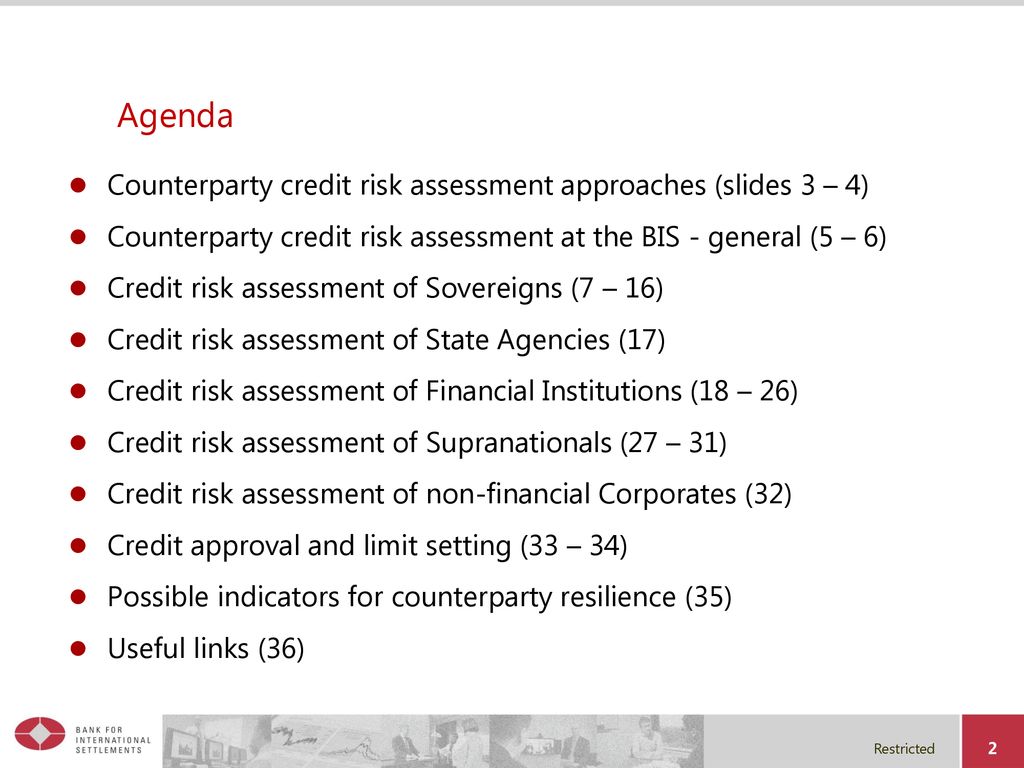

Counterparty Credit Risk Assessment At The Bis Ppt Download

Counterparty Credit Risk Assessment At The Bis Ppt Download

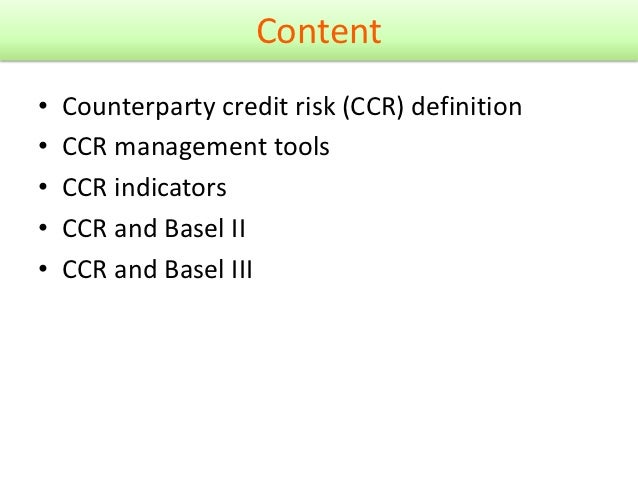

Counterparty Credit Risk General Review

Counterparty Credit Risk General Review

Oneview For Margin Numerix

Oneview For Margin Numerix

Https Conference Afponline Org Docs Default Source Default Document Library Sp Risky Business Best Practices In Counterparty Credit Risk Management Session 150 Pdf

![]() Margin In Derivatives Trading Risk Books

Margin In Derivatives Trading Risk Books