Counterparty Risk

The risk of counterparty default was already covered in basel i and basel ii. Counterparty risk is the likelihood or probability that one of those involved in a transaction might default on its contractual obligation.

Sap Library Credit Risk Analyzer

Sap Library Credit Risk Analyzer

A counterparty sometimes contraparty is a legal entity unincorporated entity or collection of entities to which an exposure to financial risk might exist.

Counterparty risk. Hope this article introduced you to the counterparty credit risk. If bank a loans 10 million to customer c bank a charges a yield that includes compensation for default risk. The word became widely used in the 1980s particularly at the time of the basel i in 1988.

Counterparty risk is the risk that the person or institution with whom you have entered a financial contract who is a counterparty to the contract will default on the obligation and fail to fulfill that side of the contractual agreement. To help alleviate this risk derivatives trades. Counterparty credit risk is a big area in risk management.

Counterparty risk is the risk of one or more parties in a financial transaction defaulting on or otherwise failing to meet their obligations on that trade. The numerical value of a borrowers credit score reflects the level of counterparty risk to the lender or creditor. This topic introduced counterparty credit risk and highlighted common terminology used in risk management.

Doing so introduces counterparty risk as the centralized exchange controls your private keys and thus may or may not have enough funds on hand to cover every depositor. The basel iii reforms introduced a new capital charge for the risk of loss due to the deterioration in the creditworthiness of the counterparty to a derivatives transaction or an sft. A counterparty risk also known as a default risk or counterparty credit risk ccr is a risk that a counterparty will not pay as obligated on a bond derivative insurance policy or other contract.

This potential mark to market loss is known as cva risk. It also explained how credit risk can be measured reduced and mitigated. A systematic approach will not only help mitigate unwanted riskit will also improve capital efficiency.

Please let me know if you have any feedback. Lets contrast counterparty risk to loan default risk. Counterparty risk is a type or sub class of credit risk and is the risk of default by the counterparty in many forms of derivative contracts.

Counterparty risk is especially relevant to derivatives markets where notional values can far exceed the size of the underlying securities. Counterparty risk is commonly discussed in the cryptocurrency sphere as it pertains to holding coins on a centralized exchange. Counterparty risk is a highly complex topic spanning several units and involving many stakeholders document handovers and potential exceptions an end to end view on the processes is essential.

Counterparty risk can exist in credit investment and trading transactions.

Counterparty Risk Management For Corporate Treasury Functions

Counterparty Risk Management For Corporate Treasury Functions

Counterparty Risk Solution Quantifi Celent

Counterparty Risk Solution Quantifi Celent

Counterparty Credit Risk General Review

Counterparty Credit Risk General Review

Xinfin And Trace Financial To Provide Blockchain Powered

Xinfin And Trace Financial To Provide Blockchain Powered

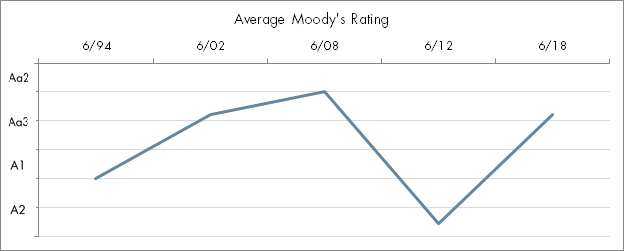

Counterparty Credit Risk Measurement Rules And Estimation Methods

Counterparty Credit Risk Measurement Rules And Estimation Methods

Mizuho Dl Financial Technology Counterparty Risk Management

Mizuho Dl Financial Technology Counterparty Risk Management

Xinfin Blockchain Network And Trace Financial Team Up To Provide

Xinfin Blockchain Network And Trace Financial Team Up To Provide

Dec2016 Calculating And Managing Environmental Counterparty Risk

Dec2016 Calculating And Managing Environmental Counterparty Risk

Basel Rules Counterparty Risk Ppt Example Powerpoint Templates

Basel Rules Counterparty Risk Ppt Example Powerpoint Templates

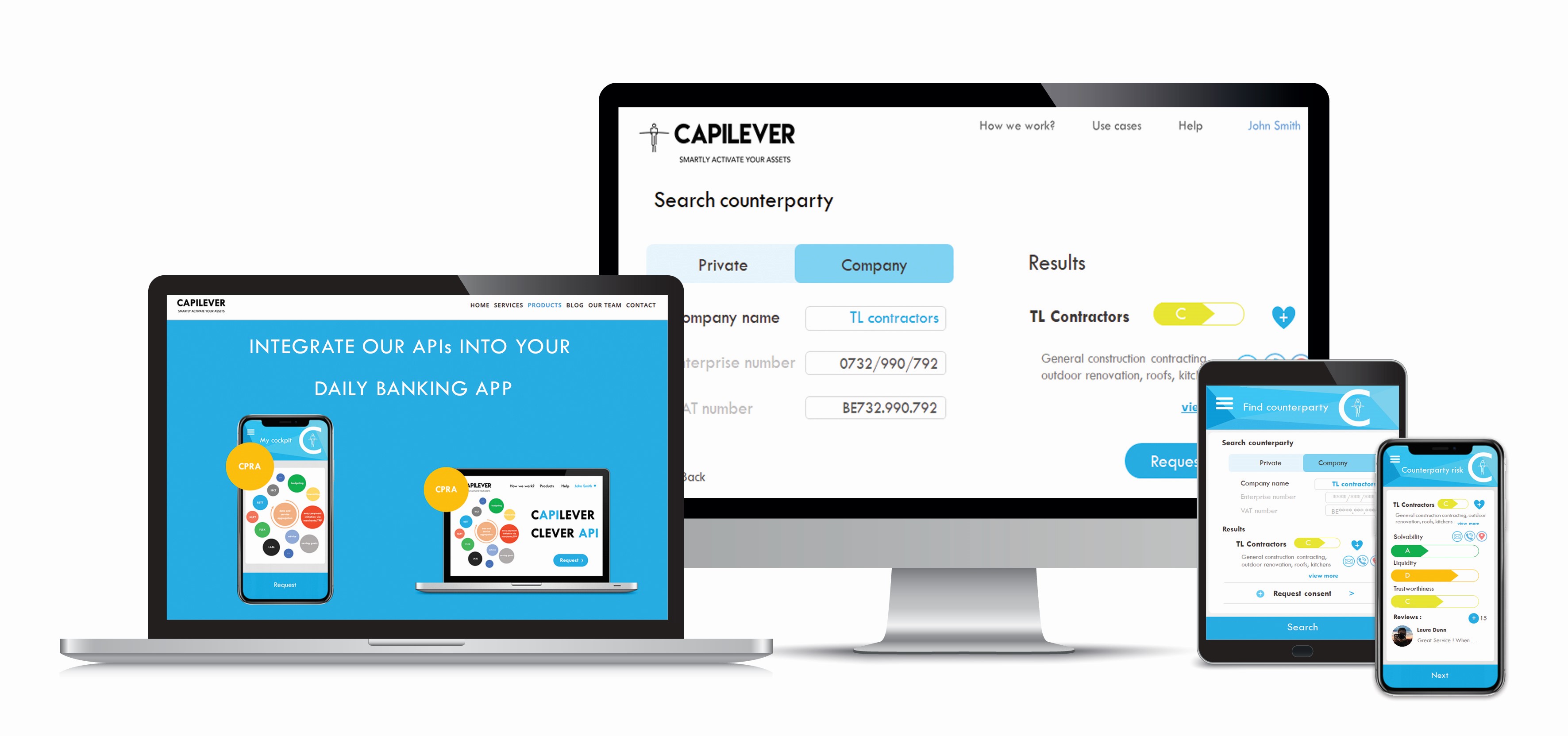

Capilever Counterparty Risk Assessment Cpra Solution Capilever

Capilever Counterparty Risk Assessment Cpra Solution Capilever

Counterparty Risk And Mitigation Strategies In Derivative

Counterparty Risk And Mitigation Strategies In Derivative